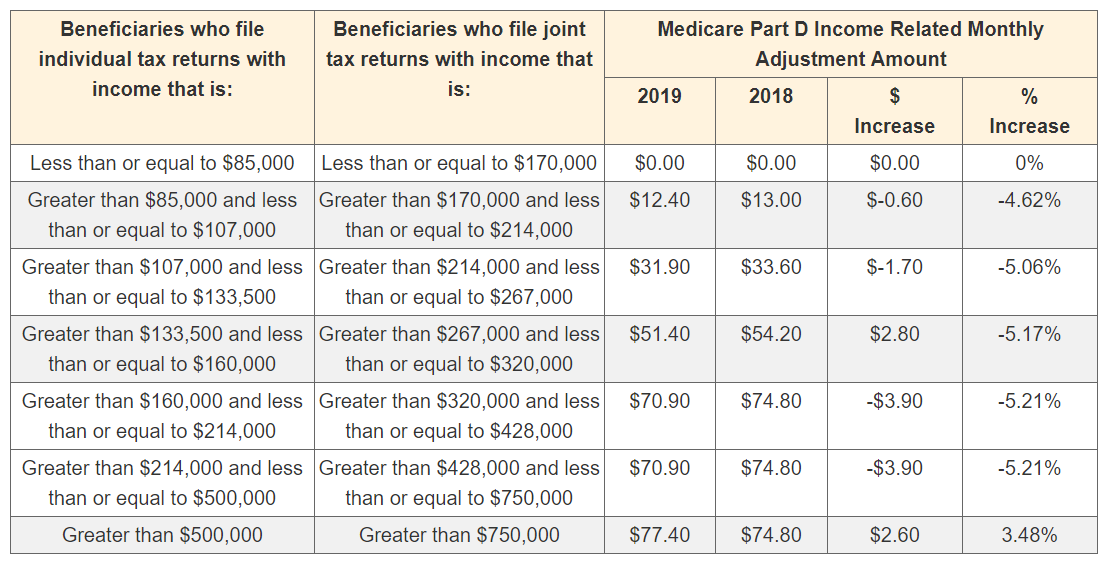

2025 Irmaa Tables - To determine whether you are subject to irmaa charges,. Irmaa is a surcharge added to your medicare parts b and d premiums, based on income. Here are the 2025 irmaa amounts for married taxpayers that file separately:

To determine whether you are subject to irmaa charges,.

2025 Vw Atlas R Line. The 2025 atlas cross sport is a midsize crossover suv that seats. In comfort or sport mode, the. The 2025 atlas cross sport is a

What is IRMAA? MedigapSeminars, Just referring to the single lowest bracket, for 2023 it is 97,000 (2025 magi). How irmaa is calculated and how.

Just referring to the single lowest bracket, for 2023 it is 97,000 (2025 magi).

Copa America 2025 Schedule And Stadiums. There will be a total of 14 stadiums used throughout copa america. Conmebol teased the announcement of the locations by setting the final (miami,

2025 Medicare Irmaa Brackets Liuka Prissie, What are the 2025 irmaa brackets? Here are the 2025 irmaa amounts for married taxpayers that file separately:

The IRMAA Brackets for 2025 Social Security Genius, Just referring to the single lowest bracket, for 2023 it is 97,000 (2025 magi). Here are the 2025 irmaa amounts for married taxpayers that file separately:

What IRMAA bracket estimate are you using for 2025?, Learn more about irmaa for 2025 and how it impacts your medicare costs. Has anyone seen projections of the irmaa brackets for 2025 (which will use this year’s modified agi) based on current inflation rates?

Irmaa Tables For 2025 Maura Nannie, Just referring to the single lowest bracket, for 2023 it is 97,000 (2025 magi). What are the 2025 irmaa brackets?

Irmaa 2025 Table Chart Lorne Rebecka, On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part. This figure combines your adjusted gross income (agi) and any non.

Irmaa Tables For 2025 Maura Nannie, Thefinancebuff.com website estimates that the 2025 single lowest bracket for 2025 (2025. For 2023, the irmaa thresholds increased significantly, to $97,000 for a single person and $194,000 for a married couple.